Time For A New Ethereum Upgrade

I thought it was time to put my focus back on projects and developments in the best crypto projects after a long period of crypto drama following the FTX Collapse and Genesis’s bankruptcy. After all, the important factors for long-term growth of the crypto ecosystem are: adoption and developments.

Starting with one of the most well-known projects in the crypto space: Ethereum. It is about time for a new Ethereum upgrade! The last time I looked at the project was during their merge. You can read Ethereum update on the merge back in September 2022 here.

Ethereum Merge In A Nutshell

For those of you who need a refresh, the Ethereum merge was just a technical upgrade where two component of the Ethereum network were combined as part of the main network. It was the first of a series of Ethereum upgrades to be made on the network to solve issues related to its speed, scalability, security, and overall technical capabilities.

Post-Merge Ethereum

After launch day on September 15, 2022, post-merge Ethereum was literally flawless. Or at the least no technical problems resulted in validator attacks, network down time, nor any of the doom case scenarios like forking or the likes of it.

Proof-of-Stake (PoS) Ethereum also became one of the most sustainable decentralized networks in the crypto space at the moment. PoS Ethereum uses 99,5% less energy that its previous version before the merge.

However, the post-merge version of Ethereum has one big issue right now: network centralization.

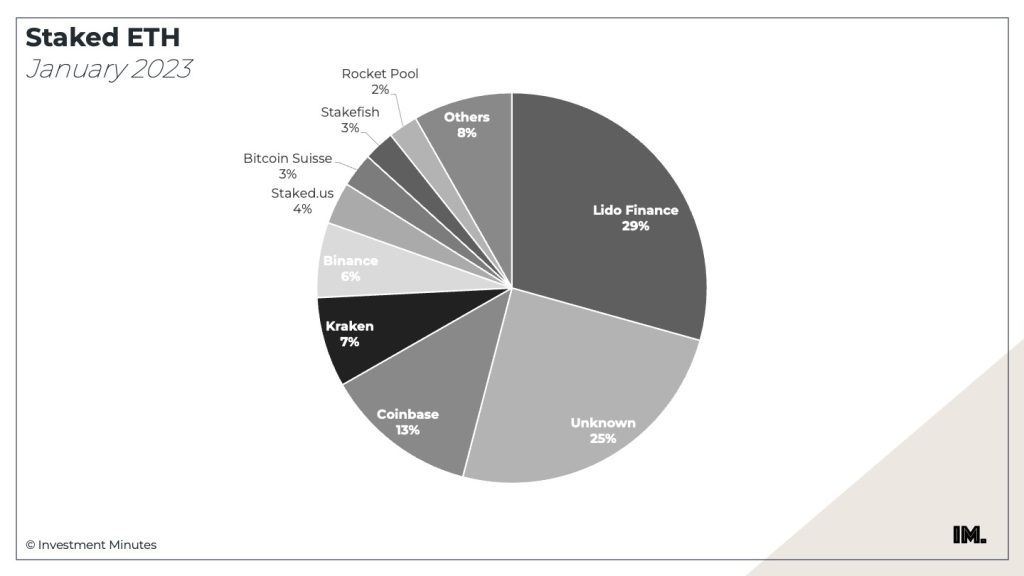

After the merge, just 5 entities control 80% of the staked ETH tokens:

Lido Finance, Coinbase, Kraken, Binance, and an Unknown investor holding 25% of the stake ETH!

Source: pro.nansen.ai

Why Can Ethereum Centralization Be An Issue?

Network centralization as a result of the merge might be a big issue for the Ethereum ecosystem. This has to do with the possibility of Ethereum being seen as a security token according to the Securities and Exchange Commission (SEC).

The SEC uses the Howey Test to determine whether a financial instrument classifies as a security. The same test evaluates all crypto tokens with no exception. So far, the only two tokens that survived the Howey Test are Bitcoin and, so far, Ethereum. Bitcoin officially qualified as a currency. Ethereum, up until the merge, as a commodity.

What Is The Howey Test?

The Howey Test consists of four fundamental questions about the nature of the financial instrument:

- Did you use (fiat) money to buy it?

- Is the price equal for everyone?

- Are you expecting a profit?

- Is the expectation linked to one specific entity or person?

When the answer to all 4 questions is YES, then the financial product is a security according to the SEC. This has implication in the way institutional investors can build exposure into these assets and obviously how these are taxed.

ETH As A Security After Ethereum Update

Note that for all crypto tokens out there, the answer to questions 1, 2, and 3 is YES.

The most important question in the Howey Test is number 4: is the expectation linked to one specific entity or person?

This is exactly why decentralization is key. When a network is sufficiently decentralized, someone’s expectation of profits linked to the token is not attributed to one entity. Therefore, the token is not a security! However, with centralized network, that will not be the case.

The “Shanghai” Upgrade

Vitalik’s creativity in naming the Ethereum upgrades has no limits. The next one is called Shanghai.

Rumors are, the Shanghai Upgrade will launch in March 2023. With this upgrade, Ethereum validators will have the possibility to withdraw both their staked ETH and rewards accrued so far. The development seems to go at full steam, despite some discussions over the serialization method which I will omit in this article. A test network launched in February 2023!

Ethereum Upgrade & Withdrawals

Just like the merge, this Ethereum upgrade is a technical one and prepares the network for follow up upgrades addressing speed, scalability, and security.

So, withdrawals. Since the switch to proof-of-stake, about 500.000 validators have been staking ethers (32 ETH each to be precise) to operate in the network. Since September 2022, these ETH tokens are locked. This means the validators cannot withdraw them and exchange them in the market for cash. On top of that, all rewards earned on their staked ETH are also locked.

With the withdrawal function being launched with the Shanghai Upgrade, validators can withdraw their staked ETH and earned rewards.

One of the big concerns of this Ethereum upgrade is that all of the ETH locked so far will hit the market. After all, who wouldn’t want to take some profits in these harsh times in the crypto market! There is indeed a strong change that a lot of the validators are in financial troubles in the wake of FTX and Genesis.

How Likely Is The BIG Withdrawal After The Ethereum Upgrade?

According to Ethereum devs, there will be two types of withdrawals.

- Type 1 – Partial Withdrawal

This allows validators to withdraw staking rewards only and it will be enabled immediately after the launch. In a partial withdrawal, the initial position of 32 ETH will remain locked.

- Type 2 – Full Withdrawal

Validators are allowed to withdraw both the 32 ETH and rewards accrued so far. However, full withdrawal will be limited by the protocol to a maximum rate per day.

The maximum rate depends on the number of available validators on the Ethereum network. The limits are already implemented in the network, following the table below, based on a maximum rate in validators/epoch, with 1 epoch being equal to 6,4 minutes.

Active Validators | Max Validators/Epoch | Max Validators/Day |

|---|---|---|

327680 | 5 | 1125 |

393216 | 6 | 1350 |

458752 | 7 | 1575 |

524288 | 8 | 1800 |

589824 | 9 | 2025 |

655360 | 10 | 2200 |

The network oeprates with 509000 validators at the moment. This means that after the Ethereum upgrade, a total of 1575 validators a day can do a full ETH withdrawal.

Assuming a price of $1600 per ETH on the market, this makes the upcoming sell pressure $80,64 million per day.

At this point, no single exchange can handle that type of sell pressure. The average market depth is at $10 million. However, no validator is so dumb to dump all their ETH on 1 exchange. By doing that, they will cause a massive movement in the ETH price, also damaging their own liquidity. I expect most of them will use an OTC desk to sell their ETH, should they need to.

In short, I expect most validators to withdraw staking rewards. And the minority of them their full account, especially if under financial pressure due to recent events. However, this might not necessarily mean a big price movement downwards for ETH.

I see two main counterforces to this sell pressure: pre-programmed withdrawal limits, and increasing staking returns (APR).

Some Counterforces To The Sell Pressure

With the incumbent sell pressure on ETH tokens, the number of validators might drop. A lower amount of validators will trigger two counterbalancing mechanisms:

- lower withdrawal limits, and

- higher staking returns (APR).

In turn, higher staking returns stimulate validators to stay or new validators to join. For example, the amount of users staking their ETH is at all time lows at the moment. Only 14%, compared to Cardano’s 60-70%. So with higher staking returns, more retail investors might start flocking to Ethereum network and stake their ETH position in exchange for higher rewards.

My Conclusions & Risks Post-Etherum Upgrade

All taken into account, I still think macro-economics will weigh much higher than any dynamic in the Ethereum ecosystem. So I expect that much of the price movements following the Ethereum upgrade will be insignificant compared to much more pressing news around energy crisis, politics, the upcoming real estate crash, and so forth.

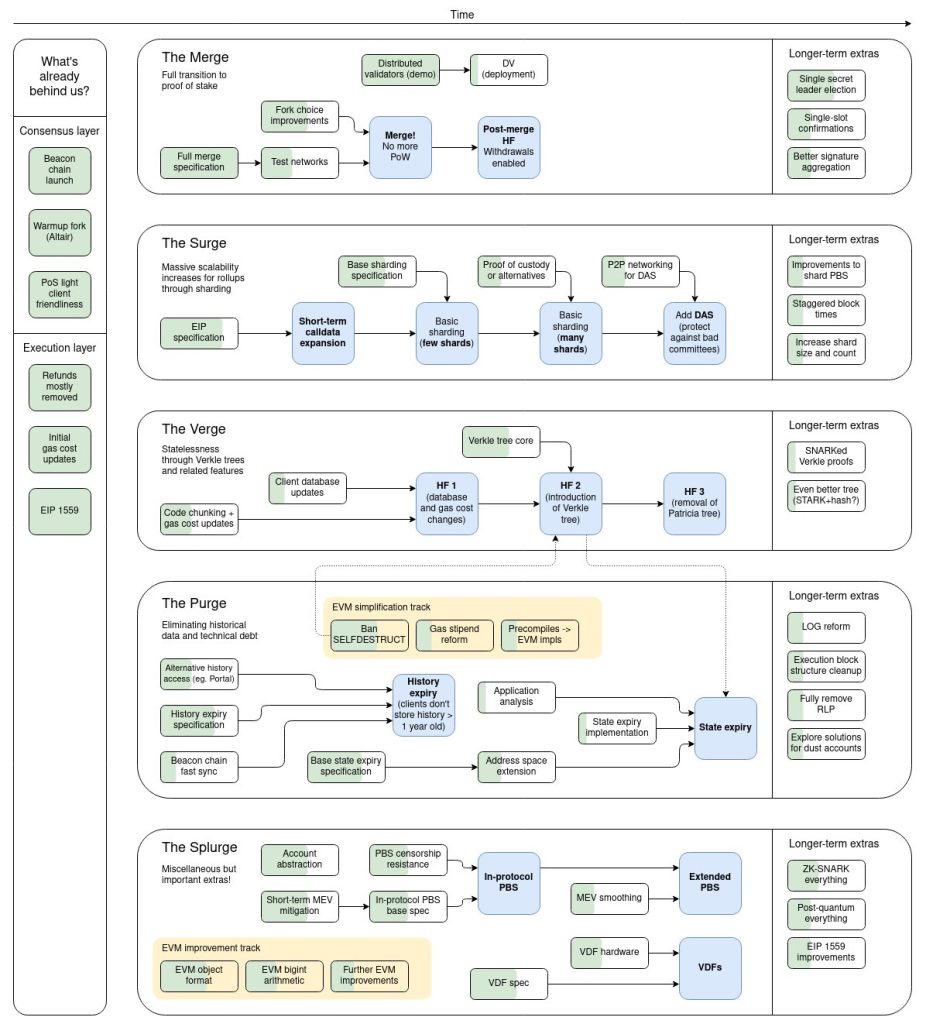

For Ethereum I am very much looking forward to the next steps in their roadmap addressing their speed, scalability, centralization, and security issues. I will add the full timeline, including all the exotic names, below. This is eventually what drives the value of the entire Ethereum ecosystem.

Happy birthday beacon chain!

— vitalik.eth (@VitalikButerin) December 2, 2021

Here's an updated roadmap diagram for where Ethereum protocol development is at and what's coming in what order.

(I'm sure this is missing a lot, as all diagrams are, but it covers a lot of the important stuff!) pic.twitter.com/puWP7hwDlx

Newsletter

Stay up-to-date with the latest developments in the stock and crypto market., fund, and crypto market.

Disclosure

These are unqualified opinions, and this newsletter, is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor, and do your own research.

No comment yet, add your voice below!