Why Are BTC Miners Important To Look At?

This question is a central point at the heart of my investment thesis in crypto assets. This is the reason why I am taking another look at Bitcoin miners and assess the health of the ecosystem after the s*itshow related to FTX. More on it in this previous article.

Before we get to the juicy part, let me refresh your memory on why BTC mining corporation as such an essential piece of the puzzle.

As mentioned in my August 2022 update on BTC mining corporations (read article here), there are three central assumptions behind my investment thesis in crypto assets:

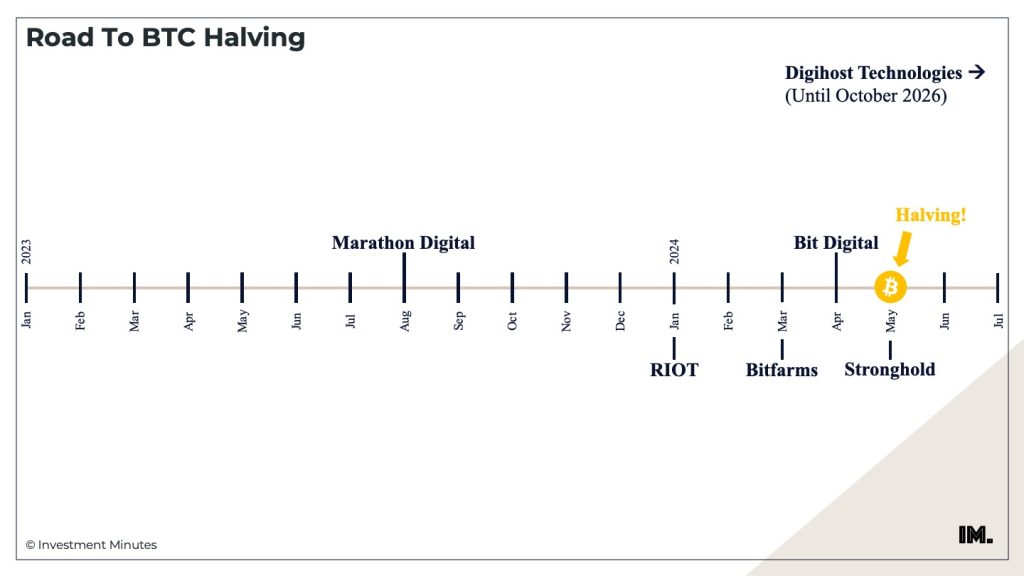

- Bitcoin Halving Event – The ecosystem is preparing for another big halving event, scheduled on May 2024 – this is the point in time when the BTC rewards get cut in half. This means that miners, investing in the process of generating new BTC, will get rewarded less. This makes BTC less liquid in the market and more difficult to mine.

- Miners Accumulation – As miners get more access to traditional sources of capital, they can hold on their BTC rewards. This makes BTC even more liquid and thus scarce in the market.

- Institutional Acceptance – The more institutional investors use BTC as a store of value, the higher the price, the less BTC will be available on the market.

Some Basic Observations

The Bitcoin Halving Event is scheduled for May 1, 2024 09:34:30 PM UTC. For those of you who might hear this for the first time, the halving event is that moment in time when the BTC rewards for miners are cut by 50%. This happens every 4 years. The mechanics around the halving event are pretty predictable. Leading up to the halving miners ramp up activities to gain as many of the last high BTC rewards. After the halving BTC becomes more scarce in the market, as fewer and fewer BTC will be available in the market.

Institutional acceptance is an important factor for the crypto ecosystem’s growth on the long term. But, this is something that will get triggered later in the game. The scarcer BTC, the better its role as store of value. This will only come provided a) successful halving events, b) healthy BTC mining ecosystem. Since I have been investing in crypto, I keep reiterating that because of institutional acceptance we will see the number of Bitcoin users growing to billions! Institutional entry in this market is still in the making, with some initiatives being brought to the market as we speak.

🗓️ August 2022

BlackRock, the world’s largest wealth manager with close to 10 billion under management, partners with Coinbase to develop infrastructure so that their financial advisors can start allocating a percentage of their portfolio to crypto assets.

🗓️ September 2022

BNY Mellon, America’s oldest bank, announced they launched support for custody of digital assets. What fueled this initiative is a poll led by Fidelity indicating that 91% of their institutional clients in the US are open to building allocation in crypto assets.

🗓️ October 2022

Google is implementing digital payment solutions based on crypto assets for their could services. This is very relevant since Google started offering nodes and cloud services for network validators.

The Key To A Healthy BTC Ecosystem

So with the Bitoin Halving being a given and the institutional acceptance being conditional to BTC establishing itself as a store of value, we are left with only one key assumption: a healthy miners ecosystem.

What this is actually saying is that the healthier the BTC mining corporation, the more stable the ecosystem. If that assumption falls, the entire BTC ecosystem will continue experience the volatility we are used to and reduce the chances to elevate crypto assets to the status of store of value needed to further scale institutional acceptance.

So the key to a healthy BTC ecosystem are actually its mining companies.

These are the backbone of the infrastructure: the decentralized computers that process the transactions on the Bitcoin network. Without them, there would be no Bitcoin to accumulate or use as a payment method.

BTC Miners’ Biggest Problem: “The Double Squeeze”

The reason why I am taking another look at the health of BTC mining corporation is something I call “The Double Squeeze”.

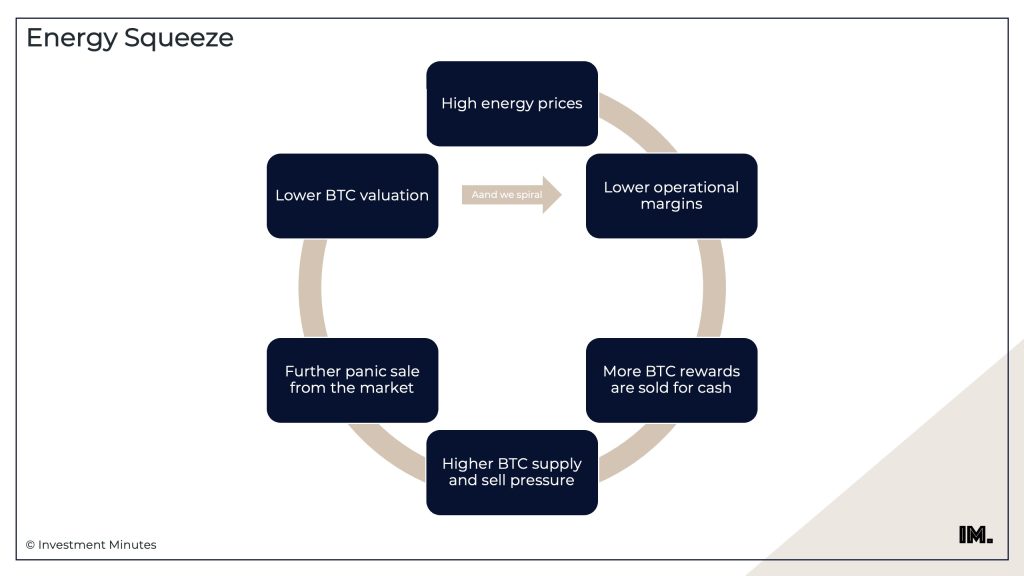

Energy Prices

The first squeeze is because of rising energy prices. The recent ABSURD increase in energy prices is squeezing the miners’ margins and FORCES them to SELL BTC to pay salaries and keep their operation alive. Despite the loss they are taking on BTC because of the low prices. Since October 2022, miners are selling an average of 70 BTC per day, for a total liquidation of 8% of their holding. The last time miners were forced to sell this much was back in 2013. This is mostly because the average miners earns $0,05 per terahash of computing power: the lowest profitability ever recorded on the Bitcoin network. The profitability dropped 83% compared to the network’s all-time high.

This is a self-destructive cycle for crypto investments. High energy prices —> lower margins —> more BTC are sold in exchange for cash —> lower BTC price —> lower margins (and the cycle repeats in a downward spiral). The spiral reverses if margins are somehow restored or energy prices drop!

Usually the miners economics are such that 80% of their costs are for the energy supply. Typically 57% of their energy supply comes from renewable sources. The other 43% from natural gas and coal. The BIG problem is that the energy prices for these two categories almost doubled since the beginning of the year! With natural gas 102% more expensive and coal 132%.

This trend is worrisome and might cause a further decline in BTC price if the energy prices do not drop and stabilize. This will continue as long as BTC price stays around $20.000.

Capital Squeeze

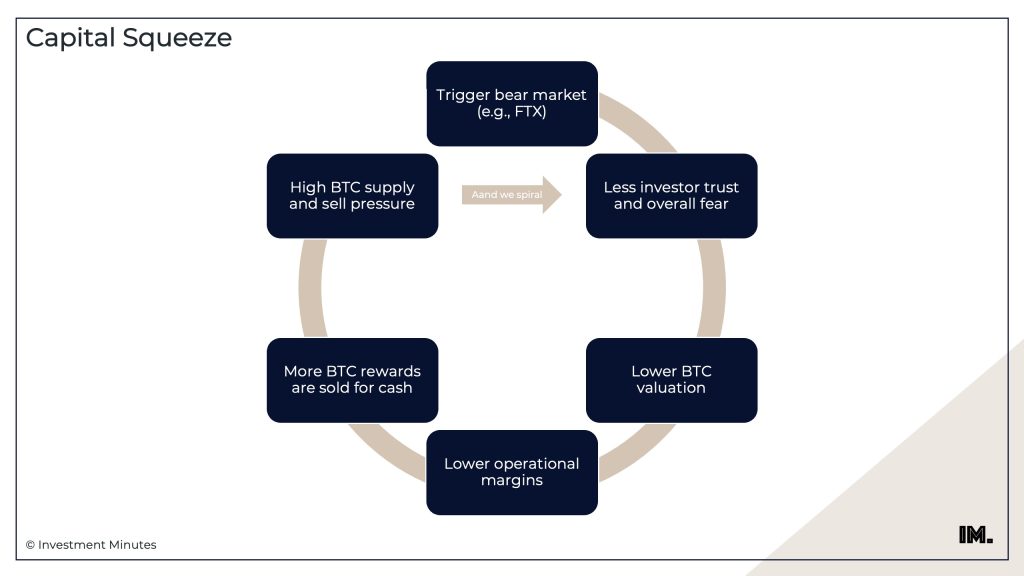

The second squeeze is due to investors losing trust in the crypto ecosystem after recent events, for example the bankruptcy of FTX.

This is also a self-destructive cycle for crypto investments. Lower trust —> lower BTC valuation —> lower operational margins —> more BTC are sold in exchange for cash —> lower BTC valuation —> even lower investor trust (and the cycle repeats in a downward spiral). The spiral reverses if trust is restored!

How Are BTC Miners Actually Doing?

In my previous article, I selected some of the largest, stock-listed, mining corporations as a proxy of the market. My assumption here is simple: if these can’t make it, we have a problem, Houston. Then even if a small privately-owned miner survives, the ecosystem is not heathy enough to scale! So, for my theory to work, it is important to understand their chances at survival.

Here are the mining corporations we will reassess in terms of cash position, runway, and potential risks leading up to the Bitcoin Halving event in May 2024.

Bitfarms (BITF)

Bit Digital (BTBT)

Digihost Technologies (DGHI)

Marathon Digital (MARA)

RIOT Blockchain (RIOT)

Stronghold Digital (SDIG)

Voyager Digitaal (VYGVF) ➡️ This one went bankrupt as of my August 2022 update already.

Note: only one of these miners is in my portfolio (let’s see if you can guess which one – leave a message below!). So this article is purely a market study to understand how the industry is actually doing! All the information shares in this article is taken from Yahoo Finance and annual reports (I also added the links, if interested!).

Read previous article here for a more extensive introduction of the BTC mining corporation.

Snapshot BTC Miners December 2022

If we look at what happened to some of the largest BTC mining corporations, there’s a few themes that are very hot at the moment: investing in renewable energy sources, reducing operational expenses. But do they have a change at survival until the BTC Halving?

Corporation | Cash Position | Runway | Likely to Sell BTC | What has happened since August 2022? |

|---|---|---|---|---|

BITF | $ 237 M | 15 months | Yes | Expanded their network with 30.500 nodes, including a new mining facility in Argentina. Burn rate dropped by 36%. A total of 480BTC has been sold since August. |

BTBT | $ 46 M | 16 months | No | Only 38% of the network has been activated after their move to the US. Big update will have to be made on the net once active. No significant change in their operational costs. |

DGHI | $ 253 M | 46 months | No | Runs like Swiss work! This is the healthiest mining company out there. And proudly in my stock portfolio as well 😉 |

MARA | $ 52 M | 8 months | Yes | Turned extremely asset-light and invested a lot in a renewing energy sources during their move to Texas/Nebraska. Significant reduction in operational costs by 77%! |

RIOT | $ 300 M | 13 months | No | Big capital raise and BTC liquidation to further increase their data storage capacity (in Whinstone, Texas). Operational costs dropped by 50%. |

SDIG | $ 27 M | 17 months | Yes | Massive investments in renewable energy sources (also an official electricity provider in Pennsylvania!). Operations dramatically cut by 86%. |

My Final Observations On BTC Miners

Bottom line, BTC miners are still in a vulnerable position at the moment.

We have 1/6 miners is in a position to reach the halving and cruise after with no issue whatsoever: Digihost Technologies.

The other 3/6 companies being in a great strategic position to make it until the halving event in May 2024. However, their current capital runs out around the halving. This might be a problem since they would be forced to sell their (lower) BTC rewards to keep up with the new network standards.

Another 2/6 with a weaker financial position, making it difficult for them to even reach the halving point!

What needs to happen for miners to survive until the next halving?

Just to be clear: I am not just talking about a few miners surviving.

For the assumption of BTC accumulation to hold, the mining industry will have to thrive!

• Low & stable energy prices

The increase in energy prices was the biggest driver of the reversal after the bubble in 2021. Miners are able to mine 1 BTC anywhere between $ 5.000 and $ 13.000. So with BTC prices dropping under $ 20.000 and energy prices doubling, their margins squeezed both top-down and bottom-up. Even if BTC remains around $ 20.000, by resolving the energy crisis we are facing, they will have more room to manage their operations until the halving event.

• BTC stable around $ 60.000

With BTC stabilizing around $ 60.000 in the course of 2023, miners can reach a healthy cruise-mode allowing them to prepare operations to optimize the halving and the transition to lower BTC rewards and more difficult mining operations. If this event happens, smaller miners will also be in a position to do so which will benefit the industry as a whole.

• Government Approval

This all theory will crumble the moment governments will ban mining, similar to what China did some time back. A ban has tremendous consequences not only for the temporary BTC price, but for the entire crypto ecosystem. Moving operations to another country is a HUGE effort that few companies can afford, it is capital-intensive and requires a lot of time.

Newsletter

Stay up-to-date with the latest developments in the stock and crypto market., fund, and crypto market.

(function() { window.mc4wp = window.mc4wp || { listeners: [], forms: { on: function(evt, cb) { window.mc4wp.listeners.push( { event : evt, callback: cb } ); } } } })();

.form { position: relative; left: 50%; transform: translate(-50%); height: 50px; width: 500px; opacity: 0.5; }

.button { position: relative; left: 50%; transform: translate(-50%); background-color: #54595f; border: none; border-radius: 5px; box-shadow: 0px 8px 15px rgba(0, 0, 0, 0.1); width: 116.859; height: 45px; line-height: 15px; color: white; padding: 15px 32px; text-align: center; text-decoration: none; display: inline-block; font-size: 15px; margin: 4px 2px; cursor: pointer; font-family: "Roboto", Sans-serif; }

Disclosure

These are unqualified opinions, and this newsletter, is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor, and do your own research.

No comment yet, add your voice below!