Polygon Who?!

If the names doesn’t ring a bell – you are reading the right article!

The Polygon network is one of my favorite blockchain project. And not only mine, this is one of the best funded projects out there, with more about $ 450 million in venture capital received after IPO. This is unique, trust me! I think NO project has ever received this much investor support after IPO.

In this article I will explain you why I am a big supported of the Polygon network, why I am invested in the Polygon MATIC token, and also some risks I see with this project.

Introducing Polygon Network

Polygon Network, or originally the MATIC Network, is THE Ethereum (ETH) scaling solution on a mission to make web3 more accessible. What this means is that they allow companies and institutions to build decentralized services on their network. Their offer consists of various side chain solutions where developers can launch their decentralized application (DApps) – similarly to Linux.

So in short, Polygon Network is the Linux of web3! Where developers find a number of useful tools to develop their own decentralized application. Some people also compare it to the App Store. Which is also fair!

What is a decentralized application? To give you an example, you could build a decentralized voting system using their Polygon DAO (Decentralized Autonomous Organization) and identity voters with the Polygon ID (Decentralized Digital ID Solution). So in a not-so-far-future, we might be able to vote our next president through a government (decentralized) voting system logging in with our own unique digital passport.

Fun fact: while writing this, I am remembering that just a few days ago I was walking to the mailbox to send my paper documents to the Italian Consulate in The Netherlands to initiate my passport renewal. When I think of what I still need to go through to get a new passport in 2022, this blockchain solution seems centuries ahead. But on the positive side, this just shows HOW much of an impact this stuff can have on our daily life!

Back to Polygon.

Why Polygon?

What makes the network very attractive is their speed. Polygon’s transaction processing is FAST. The network is able to crunch 7000 transaction per second! To give you an example, ETH is currently able to process only 15 transactions per second.

How is Polygon that fast?

To answer this question, we need to get a bit technical, I’m afraid.

If you don’t care, just scroll to the next paragraph entitled “What has Polygon been up to?”.

(Technical Analysis)

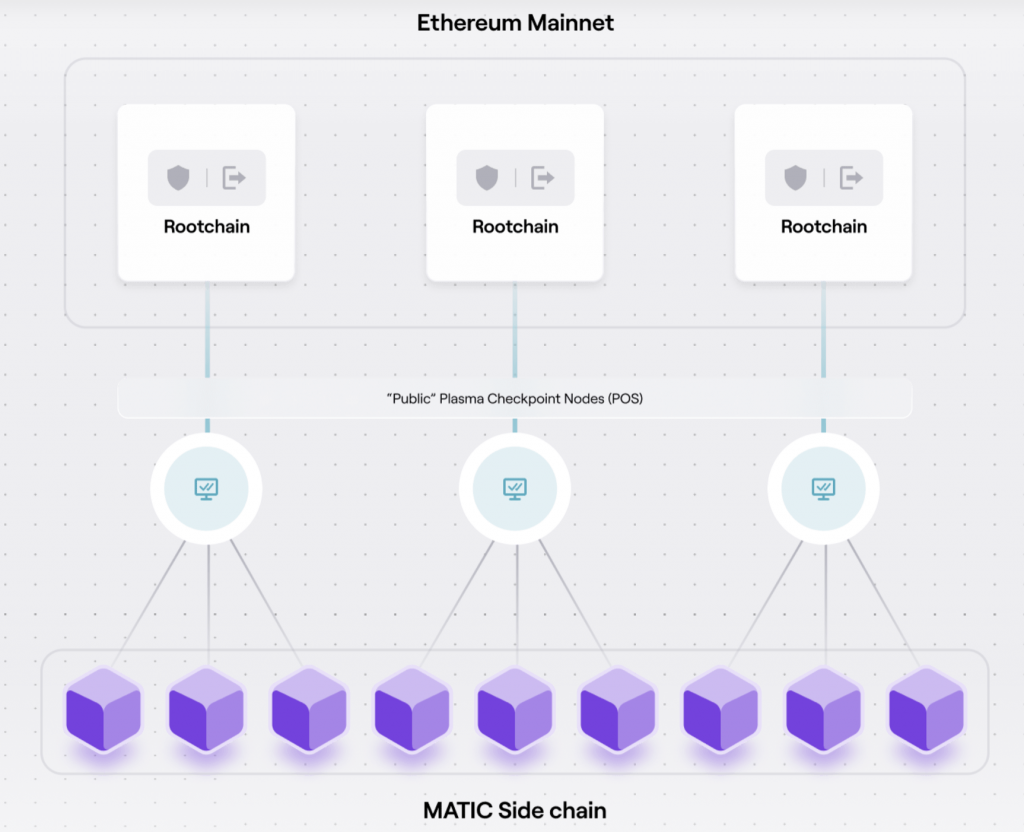

Polygon is technically a copy of ETH network that runs independently and parallel to the main network. Polygon’s side network is however centralized with only 7-10 block producers. These are selected out of a pool of validators connected to Polygon. With a snapshot of that selection uploaded on ETH network for transparency.

Validators participate in the transaction processing by staking MATIC tokens on the ETH network. There is no fixed minimum amount to stake. A validator needs to stake enough tokens based on what is needed at that moment to process a minimum of 100 blocks. Stacking rewards are currently 7-10% per year with a 21 lock-up period. Note that the MATIC tokens are also the network’s currency to pay transaction fees.

Centralizing the layer of block producers is THE key to Polygon’s speed.

Through the block producers, Polygon can realize high-throughput from the main ETH network to the side chain by batching transactions OFF the main ETH chain. On this chain, validators take over and use a Proof-of-Stake (PoS) mechanism to validate blocks.

Polygon News

Despite the recent drop in market capitalization, Polygon has been extremely active. Below a few developments worth mentioning:

- Polygon is launching its decentralized ID solution (Polygon ID) that can work in combination with the Polygon DAO to realize a decentralized 1 ID = 1 vote system

- Chicago Mercantile Exchange (CME) listed price for 11 coins, including SOL, ADA, MATIC. This is VERY important. Future trading uses CME data as reference points for their trades. Therefore, this indicates a big institutional interest in MATIC

Some BIG Developments

And, what I consider the biggest news items so far in 2022:

Polygon Nightfall is live! This is a decentralized network tool for private enterprise transaction. It allows private companies to launch their own internal DApps on the Polygon chain. One of the first pilot projects is with accounting and consulting firm EY Partners!

Meta (Facebook & Instagram) started testing their NFT solution on Polygon, amongst other networks like Solana, Cardano, Flow. With Meta stepping in the blockchain world, we are talking about a combined 4,5 billion users and even more transactions. Currently NO network can handle this type of volume. It is therefore likely that they will have to join forces to tackle that. Cross-chain interoperability will be extremely important!

More on the collaboration between Meta and Polygon in this NASDAQ article.

Last but not least:

Polygon is partnering with Disney to build a DApp that allows crowdfunding of future movies!

Remember my article about the most important factors for the 2025 crypto valuation? Well, institutional acceptance is KEY to future scalability and growth. You can read the full article here.

My Concerns

To be fully transparent with you, there are some things about Polygon Network that do worry me. I am going to summarize the most important ones here.

- Polygon’s max supply will be reached in 2025. It is not clear to me how the validators will be rewarded in the Polygon network after the max supply is reached. I heard rumours that the foundation behind Polygon Network (Polygon Foundation, based in India) might be the one providing liquidity for the validators. But my question is, where do those tokens come from?

- Polygon Technology and Polygon Foundation are both based in India. And Indian officials are notoriously anti-crypto. On top of that India is looking to roll out the digital rupee in the 2023. This initiative could either force Polygon out of India of, even worse, out of business

- MATIC is actually a stock in Polygon Technology. With the rising regulatory pressure, this might be a concern given the upcoming SEC regulatory boost on token seen as securities

Summarizing

With all said and done, I believe Polygon has the potential to bring that maturity the crypto market has been missing for so long. By allowing enterprises to build their own decentralized applications, Polygon might become the Linux of blockchain.

If this works out as described, we might see a world where blockchain fuels the back-end of the applications and services we will use daily. But we as end users will not be much aware of that system. In a similar way as we are not aware all server-to-server communication used by our laptops or phone is actually built on Linux.

To conclude, Polygon is for me a long-term investment, based on the thesis that the more enterprises use the tools they develop, the stronger the company’s position in the market, the greater for their valuation.

Newsletter

Stay up-to-date with the latest developments in the stock and crypto market., fund, and crypto market.

Disclosure

These are unqualified opinions, and this newsletter, is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor, and do your own research.

No comment yet, add your voice below!